The business environment surrounding the JAMCO Group is changing significantly and rapidly. Meanwhile, the types and nature of risks that need to be addressed and the degree of their impact are also changing rapidly. It is essential to have the risk management capabilities to respond to such changes in the business environment quickly and accurately, and we recognize that the quality of our responses will directly affect the survival of our company and the perception of our corporate value.

Thorough implementation of the JAMCO Group’s management philosophy is of utmost importance in our business activities, we consider factors that hinder the achievement of our business goals to be risks to and handle them by risk management.

We also recognize that risk management is not only about preventing or minimizing losses, but is also a strategic tool for management that should be proactively used to improve corporate value.

We will correctly identify and assess various internal and external risks that may have a significant impact on our business activities and take the most appropriate countermeasures to achieve stable and continuous development as a company.

1. We will strive to ensure the safety of our officers and employees.

2. We will prevent the loss of management resources and ensure the continuation of our business.

3. We will improve our corporate value by taking proactive measures.

4. We will be a presence that our stakeholders can be proud of.

1. Top management and all other personnel within the organization will always remember that risks exist in daily business activities and will strive to address them.

2. We will establish a risk management system for the entire Group and strive to optimize its operation.

3. When a risk becomes apparent, we will take responsible actions to improve and recover as soon as possible.

4. We will confirm the effectiveness of our risk management through internal audits, etc., and strive to enhance our risk response capabilities through continuous improvement.

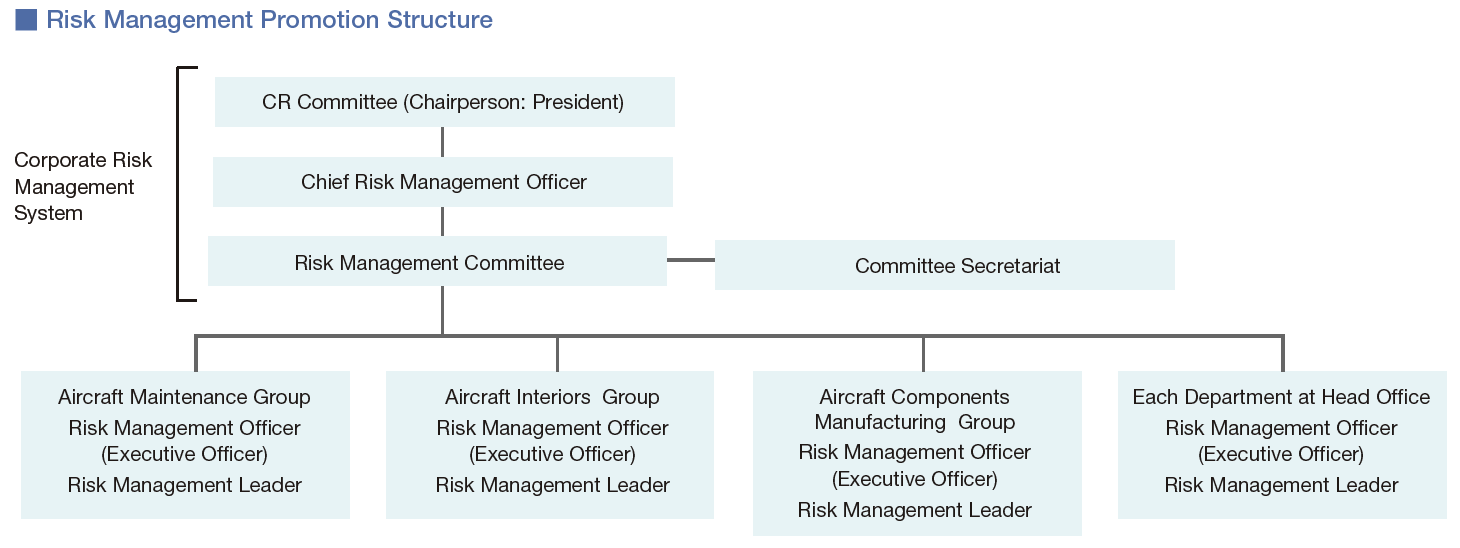

We have appointed a Chief Risk Management Officer (CRO) to be responsible for overall risk management throughout the entire company, and established the Risk Management Committee, chaired by the CRO, to function as the organization overseeing and promoting risk management.

We have established "Risk Management Regulations" as internal rules for risk management. These regulations define and implement the following items:

① Risk management policy

② Risk management initiatives

③ Risk management system

④ Risk evaluation, formulation and implementation of risk management measures

⑤ Training

⑥ Monitoring of activities

We have identified approximately 160 risks to be addressed in the areas of disaster, society, politics, economics, strategies, operations, governance, and corporate culture. Major risks affecting the company as a whole are the focus of the Risk Management Committee handled by the officers responsible for risk management in those departments. These officers assess and analyze risk, formulate measures to counter risk, and manage these initiatives on an ongoing basis. In addition, departments working directly with Group companies recognize that risks may materialize in those companies and maintain systems to work with these companies on daily risk management.

The COVID-19 pandemic has had a significant impact on Japan's people and economy, with several state of emergency declarations issued since April 2020. In addition, global air passenger demand, which has a significant impact on the Group's business, declined sharply and substantially, resulting in a significant deterioration in the business environment. We were aware of the risk of infectious disease outbreaks and have taken necessary countermeasures in the past, but the impact of the COVID-19 pandemic, which has significantly exceeded our assumptions, has caused us to revise our earlier risk assessment.